Check if there is any omission!Summary of deductions that tend to forget for year -end adjustment | @dime at daim

"Year -end adjustment" is made every year from November to December.

Although you submitted, "It's okay every year," you may be impatient, such as inadvertently finding a deduction of the declaration omission.

If you talk to the person in charge at the time of understanding, it may be in time for the deadline, but if the year -end adjustment is passed, you will file a final tax return.

It is often difficult for ordinary office workers to file a final tax return, but if you do not file a tax return, you may pay taxes that you do not need to pay.

In order not to panic later, let's check the "deduction that tends to be forgotten" if there is any omission.

List of deductions that are easy to forget by year -end adjustment

Among the many deductions, the deductions that are easy to forget to adjust the year -end are as follows.

For those who have already submitted the year -end adjustment documents, check again to see if there is anything applicable.

Life insurance premium deduction, earthquake insurance deduction

"Life insurance premium deduction" and "earthquake insurance deduction" deducted based on life insurance premiums and earthquake insurance premiums paid.

I will post it based on the "Life Insurance Premium deduction certificate" and "Earthquake insurance deduction certificate".

In the "Life Insurance Deduction", the maximum deduction amount is set for each category of the insurance contract, but a total of up to 120,000 yen can be received.

In the "Earthquake Insurance Deduction", long -term or non -life insurance premiums, which are subject to transitional measures, are also eligible for earthquake insurance deduction.The maximum deduction limit is 50,000 yen.

Social insurance premium deduction

Did you forget to fill out the deduction column after paying National Health Insurance and National Pension?

If you pay not only your insurance premium but also your family insurance premiums, you can declare your insurance premiums.

Many people know the payment of their insurance premiums, but be careful as some people, such as spouses and university students, have forgotten to pay for their family insurance premiums.

Various social insurance premiums, such as the National Health Insurance and the National Pension, are subject to various social insurance premiums, so be sure to check.

Small business mutual aid deduction

"Small business mutual aid paid" and "defined contribution pensions" are subject to "small business mutual aid deduction".

If you have a salary deduction, you may not need a procedure, but make sure there are any mistakes, such as forgetting to write the personal defined contribution pension (iDeCo).

It is important to note that entering may not be a habit, especially when you just join.

Deduction of one parent, widow deduction

Under certain requirements, if applicable, it is subject to one parent deduction or widow deduction.

Many people do not know that there is this deduction, so if you are a single parent or a widow who depends on your child or relatives, make sure.

Working student deduction

If your child is a college student working part -time, you may forget to apply a working student deduction.

To get a working student deduction, it is necessary to fall under all of the following three requirements.

(1) Income due to work such as salary income (2) The total income amount is 750,000 yen or less (650,000 yen or less before the first year of the war), and other than (1) work.The income is 100,000 yen or less (3) Being a student or student at a specific school

Make sure you have a family.

Deduction requires a final tax return

There are also deductions that require a final tax return instead of year -end adjustments, such as miscellaneous loss deduction, medical expenses deduction, and donation deduction.

You will also need a final tax return for special deductions such as housing borrowing in the first year.

Don't forget to declare deductions that require a final tax return, as they will pay too much tax if you do not file a tax return.

Be careful of year -end adjustments and forgetting to file a tax return

Forgetting year -end adjustments, tax returns, and omissions of tax returns are only disadvantaged.Even if you intend to do everything, you often have leaks because you forget it or not notice that it is in the first place.

Let's check the deductions that can be filed so that you can make appropriate declarations at the right time.

* The data is information at the time of writing.The system and content may be changed after the release, so please check the latest information on the website.* The information is made thorough, but it does not guarantee the integrity and accuracy of the content.

In the book / household account book / household management advisor Aki, "I can save money just by writing one line a day!" Zubora Household Account Book "Practice Book (Kodansha's practical BOOK)" "Akini no new Zubora Household Account Book made with a smartphone (Hidekazu System) "other

![lifehacker lifehacker LifeHacker LifeHacker A carabiner that is convenient for cutting packaging at the entrance. Excellent sharpness for medical blades! [Today's life hack tool] lifehacker lifehacker LifeHacker LifeHacker A carabiner that is convenient for cutting packaging at the entrance. Excellent sharpness for medical blades! [Today's life hack tool]](http://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/223/2022-3-2/28016.jpeg)

![lifehacker lifehacker LifeHacker LifeHacker [2021] 7 Recommended Dishwashers | Introducing High Cospa & Compact Products lifehacker lifehacker LifeHacker LifeHacker [2021] 7 Recommended Dishwashers | Introducing High Cospa & Compact Products](http://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/223/2022-3-2/30293.jpeg)

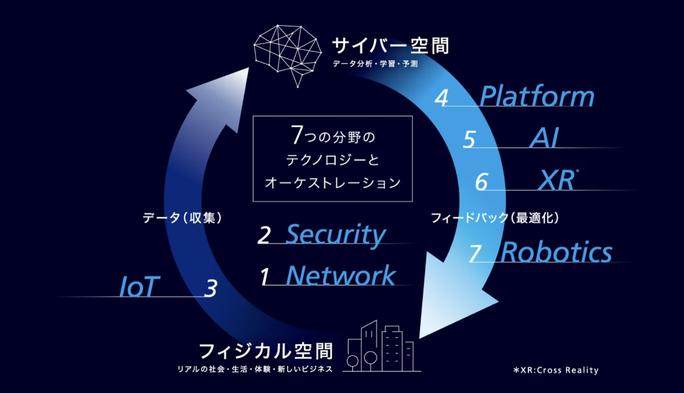

Will AI Concierge be realized in 2030? The future of KDDI's R & D (Part 1) | TIME & SPACE by KDDI

lifehacker lifehacker LifeHacker LifeHacker A carabiner that is convenient for cutting packaging at the entrance. Excellent sharpness for medical blades! [Today's life hack tool]

[2021] 11 latest recommendations for microwave ovens and ovens! Thorough explanation of how to choose

[A Certain Scientific Railgun] Popular character ranking TOP30!The first place is "Mikoto Misaka" [Survey results in 2021]