Conditions and application methods to receive "mortgage deduction" that you want to remember | @Dime at Daim

Housing is said to be the most expensive shopping in life, and most people buy long -term loans.Did you know that if you buy a house using a mortgage loan, you will be applied to "mortgage deduction" by satisfying certain conditions?

In this article, we will explain the conditions for receiving the mortgage deduction, the conditions for receiving the deduction, and how to apply.Please refer to the future trends of the system.

What is a mortgage deduction?

In the first place, what kind of system is a mortgage deduction?First, let's look at the specific mortgage deductions, the conditions for receiving the deduction, and the revised points.

Outline of mortgage deduction

The official name of the mortgage deduction, also called "mortgage tax reduction", is "Special deduction for housing borrowings."If a new home is newly built, purchased, or renovated using a mortgage, if certain conditions are met, the mortgage balance at the end of the year is equivalent to 1 % (up to 400,000 yen / 200,000 yen for used properties.) Is a system that is deducted from income tax for 10 years.It is implemented to reduce the economic burden when purchasing a house.

If the amount of income tax is less than the mortgage deduction, deduct the part that could not be deducted from the income tax from the resident tax.However, the amount that can be deducted from the resident tax has an upper limit of every year, and the total income amount is 7..It is the smaller amount of 0 % or 136,500 yen.

Mortgages include "solidarity debt type" and "pair loans" that can be borrowed by couples and two parents, and if both of them meet the conditions, it is possible to use mortgage deductions.

Conditions for receiving mortgage deductions

Next, we will introduce the main conditions for receiving a mortgage deduction.

1.The loan repayment period is 10 years or more 2.The floor area of the acquired house is 50 m2 or more (using more than half of the floor area for its own residence)4. The total income amount of the year is 30 million yen or less.Within 6 months after the house is handed out, the person receiving a mortgage deduction will live

In the case of extension and renovation, it is necessary to have more than 1 million yen in construction costs in addition to 1-4.

Mortgage deduction point revision point

The period of 1 % of the mortgage's year -end balance of the mortgage has been extended for three years to increase the consumption tax rate (October 2019).If a house with a consumption tax rate is applied, the contract conclusion date (until the end of September 2021 / Condominium and used houses are until November 2021) and the date of residence (January 1, 2021, 2021)If the conditions of ~ December 31, 2022) are met, the deduction period will increase from 10 to 13 years.

In order to receive a mortgage deduction, the floor area of the obtained housing requires more than 50 square meters, but if the total income amount is 10 million yen or less, it will be eased to more than 40 square meters in FY2021.

Mortgage deduction application method

In order to receive a mortgage deduction, you need to take some procedures.From now on, let's look at specific application methods.

Mortgage deduction application time

To receive a mortgage deduction, you must file a final tax return the year after you move in.Salary income earners are from January 4 to March 15, the year of the year they moved into the purchased house, and those who have filed a final tax return every year will be at the time of general filing from February 16 to March 15.Do it together.There are many documents required for application, so prepare as soon as possible.

As mentioned earlier, salary earners can receive a mortgage deduction only for year -end adjustments without filing a tax return after the second year.If you are not subject to year -end adjustments, such as a sole proprietor or an annual income of 20 million yen or more, you will need a final tax return.

Documents required for mortgage deduction

The following documents are required for the tax return procedure.

・ New Year's Balance Certificate of Borrowing Funds: A Certificate of Finance: A Calculation Statement for Special Deductions, etc.Download from, withholding slip (in the case of salary income): Get from work / land and building registration certificate: Acquired at the nearest legal office branch office, real estate sales contract (for housing purchase) / Construction contractContract (when renovation, etc.) ・ Documents with My Number are described

In addition, if you acquire a long -term excellent house or a second -hand apartment that meets a certain seismic standard, you need to copy a document to prove it.

Specific procedure content

Once you have the necessary documents, take it to the tax office in jurisdiction over your area.Therefore, the deduction amount is calculated using the "Calculation statement of a special deduction amount such as housing borrowed money", and the result of the result is entered in the "final tax return".After filling out two documents, submit it to the tax office along with other necessary documents and complete.This procedure can be done on mail or the Internet, so it is a good idea to choose a suitable method.

Tips you want to know

From now on, we will introduce trivia related to mortgage deduction.Be sure to check out how to calculate the mortgage deduction amount.

Mortgage deduction simulation

The mortgage deduction amount can be calculated by the formula of "Mortgage Loan Year -end balance x 1 % deduction rate".If you borrow 30 million yen, 300,000 yen can be deducted.If the deduction period is 13 years, another calculation method will be different for the 11th to 13th years.The amount of the smaller one of "the loan balance x 1 % at the end of each year" and "the acquisition amount of the building (excluding tax) x 2 % / 3" is deducted.If you use Excel, etc., it will be easier to check the deductible amount.

About future mortgage deductions

The mortgage deduction is currently being reviewed, and the deduction rate is 0 from the current 1 %..There is a plan to reduce it to 7 %.This is because there is a phenomenon that exceeds the mortgage deduction amount of the interest that actually bears.It seems that plans to extend the deduction period to 15 years.As usual, the contents of the mortgage deduction in 2022 are expected to be announced in December 2021.

Sentence / OKI

![lifehacker lifehacker LifeHacker LifeHacker A carabiner that is convenient for cutting packaging at the entrance. Excellent sharpness for medical blades! [Today's life hack tool] lifehacker lifehacker LifeHacker LifeHacker A carabiner that is convenient for cutting packaging at the entrance. Excellent sharpness for medical blades! [Today's life hack tool]](http://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/223/2022-3-2/28016.jpeg)

![lifehacker lifehacker LifeHacker LifeHacker [2021] 7 Recommended Dishwashers | Introducing High Cospa & Compact Products lifehacker lifehacker LifeHacker LifeHacker [2021] 7 Recommended Dishwashers | Introducing High Cospa & Compact Products](http://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/223/2022-3-2/30293.jpeg)

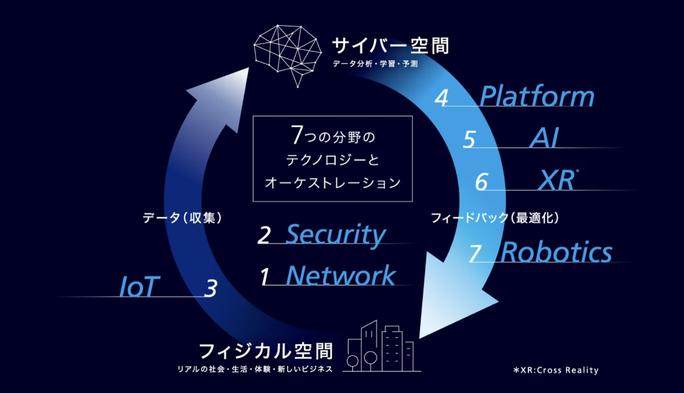

Will AI Concierge be realized in 2030? The future of KDDI's R & D (Part 1) | TIME & SPACE by KDDI

lifehacker lifehacker LifeHacker LifeHacker A carabiner that is convenient for cutting packaging at the entrance. Excellent sharpness for medical blades! [Today's life hack tool]

[2021] 11 latest recommendations for microwave ovens and ovens! Thorough explanation of how to choose

[A Certain Scientific Railgun] Popular character ranking TOP30!The first place is "Mikoto Misaka" [Survey results in 2021]