Conditions and deductions of "dependent deduction" to reduce the burden of income tax you need to remember | @Dime at Daim

One way to reduce the burden of income tax is "dependent deduction".We have summarized the basic information that you need to know, such as what the dependent deduction is like, the conditions, types, and amount of money.We will also introduce the procedure method and cases that are not eligible.

Basics of dependent deduction

First, let's check the definition of words what "dependent" is.Here are some different benefits and differences between "spouse deductions", which are often confused.

What is dependents?

Civil Code stipulates that a certain relative relationship, such as a couple, a parent and a minor child, has a duty to support each other.The definition of "dependents" described in the dictionary is "financially assisting those who cannot live on their own."

If you compare it to your home, there is a husband who is the main pillar of a family who works outside and earning income, has a wife who does not do housework and childcare, and has a student child.

From a husband's point of view, his wife and child hit the "dependent relatives", and from the perspective of his wife and his child, he is "dependent on her husband (father)."

If your wife or child starts working and your income exceeds a certain amount, you will not be subject to dependents and will be used, such as "falling out of dependents."

Difference between "spouse deduction" and "dependent deduction"

Both are one of the multiple income deductions, and is the purpose of "reducing the economic burden on taxpayers".In each case, it is necessary to have a livelihood with taxpayers, but there are differences.

In the case of "spouse deduction", it is essential to be a legal spouse, and there is no age limit.

On the other hand, "dependent deduction" has the difference between relatives other than spouse.The blood tribes in the sixth parent and the 3rd parent are applicable.

The blood tribe is a relative of taxpayers, and the marriage is a spouse's relatives.It will be a fairly wide range of relatives, and you will be free to enter your brother's dependents and your grandmother.It is also different that the age limit of 16 years or older is set.

Reference: National Tax Agency | No.1191 配偶者控除Reference: National Tax Agency | No.1180 Dependent deduction

Benefits of dependent

Being dependent not only reduces the financial burden of taxpayers, but also has a variety of benefits.

People under the age of 20 to 60 living in Japan will be the insured of the national pension, but if they are dependent, they will not be eligible.

Not only can you join the national pension without pension insurance premiums, but this period is included in the payment period, so you can receive a full benefit.

It is also an advantage that you can take out health insurance and pay a part of the medical expenses, and receive the same medical treatment as taxpayers.

It is also a great attraction for couples who are thinking about having children.

There are two types of dependent deductions

(Source) Photo-AC.com

It is easy to think that it is the same, but "dependent deduction" has two different systems, "tax system" and "social insurance."Here are some specific introductions to each.

Tax -system dependent deduction

Tax dependents are a system in which taxpayers' income tax and resident tax are reduced.

This corresponds to if the total income amount per year is 480,000 yen or less (salary income is less than 1.03 million yen if only salary).

Not only dependent deductions, but also spouse deductions and spouse special deductions are tax system.If the annual income of a dependent person or the annual income of the taxpayer exceeds the requirements, it will be excluded.

Dependent deduction for social insurance

Dependent deduction for social insurance is a system that allows you to join "Health Insurance" or "Employees' Pension Insurance" without paying insurance premiums.

I was able to receive medical care without paying insurance premiums when I was a child.If you come to work yourself and get out of your dependents, you need to pay insurance premiums.

The welfare pension insurance is also free.Originally, the benefits of not having to pay the national pension that all people need to pay will be great.

Requirements of dependent relatives

(Source) Photo-AC.com

There are conditions to enter dependents, and not everyone is eligible.Let's see what conditions are available.

Relatives who have a livelihood with taxpayers

Dependents are only for taxpayers and relatives who have livelihoods."To make a living" does not necessarily mean living together.In fact, it may be eligible even if you do not live together.

For example, even if you are separated due to work or school, if you are always sending living expenses and tuition fees, you will often be recognized as a target.It also includes cases where living expenses are sent to parents living in rural areas every month.

Conversely, if you live with your parents, you may not be eligible if you are independent of living with each other.

Reference: National Tax Agency | No.1191 Dependent deduction

The criterion is December 31 of that year

Dependent relatives are the relatives of the sixth parent other than the spouse and the marriage within the third degree.However, not everyone is a dependent relative.

The only applicable is the person who is 16 years old or older on December 31, which is the criterion.

Even if you are not a relative, there are children who have been asked to raise their prefectures and the elderly who have been asked to nursing from municipalities.

Children under the age of 16 have been excluded because they were subject to "child allowance" in the revision of the law.For children under the age of 16, describe in the declaration in the "Resident Tax Matters".

Reference: Procedure 6 Enter the matters related to residence tax | NTA

How much is the dependent deduction?

(Source) Photo-AC.com

Here are the amount of dependent deductions you are interested in.If you don't know that the amount has been reviewed in recent years, it is important to check properly.Here are some important points you need to know.

4 types of dependent deductions

There are four types of dependent deductions, each with different income tax deductions."General Dependent Relatives" between the ages of 16 and 19 and under 70 years old are "380,000 yen".

If you are 19 years old and under 23 years old, you will fall under the "Specific Dependent Relatives", which will be 250,000 and will be "630,000 yen".

In the case of "Elderly Dependent Relatives" for those over 70 years old, "480,000 yen", which is 100,000 yen added to the normal deduction amount.In the case of a taxpayer or a spouse, or if you live together, it will be "580,000 yen", which is 200,000 yen added to the normal amount.

Even if the address is different, if you live in the same apartment and spend most of your time together, you will be considered living together.

In addition, it seems that even if you have been hospitalized for a long time due to illness and separate from taxpayers, you may be living together.

Only one person can receive dependent deductions

There is a rule that only one person can receive dependent deductions by law.

For example, suppose you and your brother send your living expenses to your parents living in the countryside every month.Even if you send the same amount every month, your brothers cannot deduct their parents deducted.Only you or your brother can be the subject of dependent deduction.

On the other hand, some people may feel unequal to reduce the economic burden.You will need to discuss and decide with each other so that it does not develop into unexpected troubles.

Double -working is good if you put it in the higher income

In recent years, the number of dual -working families has increased, and some people may be worried about which child will be dependent on.

The conclusion is that it is recommended for a couple to be able to enter the higher income.This is because the tax is a mechanism that increases the deduction amount as the income is higher.

The bigger the income of the couple, the bigger the deduction amount depends on which one.If you want to increase your handling as much as possible, put it in the higher income.

It is not eligible for children under the age of 15 because they can receive dependent deductions.Regarding income tax, there is no difference in either support.

Procedures for receiving dependent deductions

(Source) Photo-AC.com

Here's how to get a dependent deduction and how to proceed.

When you go for the first time, you are confused.If you check the procedure method in advance, you will not be impatient for the deadline.

The employee submits a tax return at the end of the year

In the case of a company employee, the company's department will do tax procedures, so you do not need to do the procedure yourself.

However, regarding dependent deduction, the situation varies depending on each family, so it is necessary to declare.Specifically, when the company makes "year -end adjustment", it will be written and submitted in the tax return.

Every year around December, the company will give a "Dependent deduction (transfer) declaration", so fill in the necessary parts according to your home situation and submit it.

In addition, there are cases where the year -end adjustment is not subject to year -end adjustment, such as those who have received salaries from two or more companies.In this case, you need to file a tax return yourself.

Be careful not to pass the tax return deadline, misunderstanding that the company will do the procedure.

Reference: [Procedure name] (Transfer) Declaration of Dependent Deduction of Salary Income | National Tax Agency

提出後に修正が発生した場合

If you notice that the contents of the tax return have been wrong after the year -end adjustment, you need to correct it correctly.Until January 31 of the following year, the company can redo the year -end adjustment, so tell the person in charge immediately.

If you have passed the deadline, or if you do not want to bother the company, you can make a "final tax return" and correct it.

Some people may think, "Is the year -end adjustment and final tax return completely different?"The company performs "year -end adjustment", and there is a difference in the name of "final tax return", but there is still a matter of filing to the tax office.

Reference: No.2671 When the number of dependent relatives, etc. changes after the end of the year, the NTA

Submitted by sole proprietors

If you are not subject to sole proprietors or year -end adjustments, you need to submit a "final tax return" that calculates your income and tax from January 1 to December 31.

From February 16 to March 15, the following year, you need to submit your tax return to the tax office, so be careful not to have passed the deadline.

The description of the declaration is not particularly difficult.First, let's describe the necessary items such as the relatives' names, relationships, and date of birth in the "Dependent Deduction Document" in Table 2.Next, the deduction amount is described in the "Dependent deduction column" in "The amount deducted from the income" in the first table.

Before actually filling out, it is safe to check how to write and procedures on the NTA website.

Reference: Declaration and tax payment | National Tax Agency

Case not eligible for dependent deduction

(Source) Photo-AC.com

Depending on the situation, it may not be eligible for dependent deduction.Check what cases apply.

"Blue business -dedicated" or "Target of business deduction"

"Blue Business Supplies" will not receive dependent deduction, spouse deduction, or spouse special deductions instead of taxpayers earn as "blue business full -time salary".

If you are earning income from business or real estate, you will file a tax return called "Blue Declaration"."Blue Business Senior" is a taxpayer who files a blue declaration, a spouse who can live in life, or a relative of 15 years old or older, and has been engaged in business for more than six months.

The content of the work is not specified.It is considered that you are engaged in business, even if it does not require skills or cleaning such as telephone correspondence or cleaning up.

Reference: No.2075 Blue Business Salary Salary and Business Deduction | National Tax Agency

Total income and annual income are above the standard

Even if the total income or annual income exceeds the criteria specified by the dependent deduction, it will not be eligible for dependent deduction.

The standard for total income after 2020 is "480,000 yen or less".Until then, it was less than 380,000 yen, so it increased by 100,000 yen.

However, at the same time, the salary income deduction amount has been reduced by 100,000 yen, from 650,000 yen to 550,000 yen.Until 2019, it was necessary to add 650,000 yen and 380,000 yen in income, which is a requirement for dependent deduction, and it was less than 1.03 million yen.

After 2020, the salary income deduction must be 550,000 yen, and the income is less than 480,000 yen, which is a requirement for dependent deduction, which is less than 1.03 million yen.In other words, the total amount has not changed before and after the revision.

Reference: Revision of the total income amount requirements for dependent relatives, etc. for receiving various deductions (after 2 years for Origin) |

If the number of dependents decreases, the number of people will decrease

It is not unusual for a full -time housewife to start working full -time, become a member of society, and change lifestyles.

One of the things you need to know in advance is that if the number of dependents decreases.

This is the main reason because the system of dependent deductions is to reduce the taxpayers' tax on taxpayers with dependents.If there are no dependents, taxes will increase and salaries will be reduced even if the salary has not changed.

If the dependent is working part -time or part -time, it is important to work with the deduction conditions and annual income.There may be places where the workplace manages, but it is basically self -management.

It is not unusual to put a shift in the busy season, etc., and if you notice it, it is not unusual to have exceeded the range of deduction.

![lifehacker lifehacker LifeHacker LifeHacker A carabiner that is convenient for cutting packaging at the entrance. Excellent sharpness for medical blades! [Today's life hack tool] lifehacker lifehacker LifeHacker LifeHacker A carabiner that is convenient for cutting packaging at the entrance. Excellent sharpness for medical blades! [Today's life hack tool]](http://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/223/2022-3-2/28016.jpeg)

![lifehacker lifehacker LifeHacker LifeHacker [2021] 7 Recommended Dishwashers | Introducing High Cospa & Compact Products lifehacker lifehacker LifeHacker LifeHacker [2021] 7 Recommended Dishwashers | Introducing High Cospa & Compact Products](http://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/223/2022-3-2/30293.jpeg)

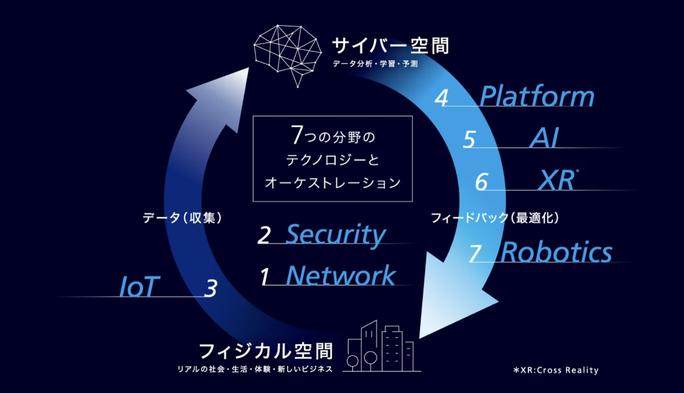

Will AI Concierge be realized in 2030? The future of KDDI's R & D (Part 1) | TIME & SPACE by KDDI

lifehacker lifehacker LifeHacker LifeHacker A carabiner that is convenient for cutting packaging at the entrance. Excellent sharpness for medical blades! [Today's life hack tool]

[2021] 11 latest recommendations for microwave ovens and ovens! Thorough explanation of how to choose

[A Certain Scientific Railgun] Popular character ranking TOP30!The first place is "Mikoto Misaka" [Survey results in 2021]