The correct calculation method and withholding of the income tax you need to remember, the meaning of year -end adjustment | @Dime at Daim

Have you ever been worried about how much income tax you have paid in a year?In fact, the amount of income tax varies greatly from person to person.This is because there are differences in income and deductions depending on the person.So how can you calculate your income tax?

Therefore, in this article, the calculation method of income tax is explained in an easy -to -understand manner.You may want to know how much you are paying your income tax and try a tax saving method that suits you.

Income tax calculation method

First, I will introduce the specific calculation method of income tax.I want you to prepare documents that know your income at hand and read it on.

Put a certain tax rate for one year income

Income tax is required by multiplying the income obtained from January 1 to December 31 of the year, with a certain percentage of the deduction.The formula is as follows.

[How to calculate income tax]

・ Income tax amount = 1 year taxable income x income tax rate-deduction amount

In order to calculate the income tax, it is necessary to calculate the "one year taxable income".The taxable income is the amount after deducting the income from the income, the required expenses, the basic deduction (480,000 yen), and the spouse deduction (130,000 to 380,000 yen).

* Please refer to the official website of the NTA for the amount of spouse deduction.

The tax rate is divided into seven stages, at least 5 % to a maximum of 45 %, depending on the income.The higher the tax rate, the larger the "deduction".

[Income tax rate and deduction amount] (as of the end of November 2021)

From 1,000 yen to 1,949,000 yen: Tax rate 5 %, deduction amount from 1,950,000 yen to 3,299,000 yen: Tax rate 10 %, deduction 97,500 yen 3,300,000 yen to 6,949,000 yen: Tax rate 20 %, deduction amount 427,500 yen 6,950,000 yen to 8,999,000 yenUp: Tax rate 23 %, deduction amount 636,000 yen 9,000 yen to 17,999,000 yen: Tax rate 33 %, deduction amount from 18,000 yen to 3999,000 yen: Tax rate 40 %, deduction amount 2,796,000 yen 40,000 yen or more: 4,79,000 yen 45 %, 4,7900,000 yen, tax rate

Income type

Knowing income at a glance is not necessarily income.If you have the following income other than your employer, they are also subject to income tax.

[Income other than salary (one example)]

・ Interest income, dividend income, real estate income, business income, forest income, transfer income, temporary income, miscellaneous income

For example, if you are investing in stocks, you may have obtained "dividend income" and "transfer income".In addition, if you are investing in real estate, "real estate income" is also involved in "miscellaneous income" if you are doing side jobs separately from your main business.Calculate the tax target income for one year by subtracting expenses, basic deductions, etc. from all of these income.

Until 2037, special reconstruction income tax also added

Special Reconstruction Income Tax is a tax introduced in 2013 to secure financial resources for the Great East Japan Earthquake that occurred in 2011.Until 2037, the income tax amount 2.1 % is added.

[Calculation method for reconstruction special income tax]

・ Reconstruction special income tax = income tax amount x 0.021

It is important to note that the special income tax on reconstruction is "2 for income.."2 %" instead of "2 %".That's 1 %.In other words, only after the income tax amount can be calculated, the amount of reconstruction special income tax can be determined.

The withholding tax deducted from the monthly salary is a temporary tax amount

When you look at the pay statement, you may have seen income tax as "withholding".This is a mechanism for a company that is a payer to collect the provisional tax amount, and the year -end adjustment is determined the correct tax amount.Let's take a closer look at the contents of withholding and year -end adjustment.

What is withholding in the first place?

If you work for a company, a certain amount of income tax is deducted from your monthly salary.This is called withholding.This is a mechanism in which companies deduct their "prospective income tax" from monthly salaries.The point is that it is a "prospective income tax".The correct tax amount is determined by the year -end adjustment described later.

Year-end adjustment

Companies, which are paid by salary, determine the correct tax amount of each person and settle the settlement.The correct income tax will be determined by submitting the year -end adjustment documents for those who are paid for salaries.At that time, it is possible to save tax (lower the taxable income amount) by submitting documents such as "insurance deduction".

If there is an overload, adjustment is usually made with a salary for December.If you have paid too much income tax, you will often be refunded at this time.

Sentence / OKI

![lifehacker lifehacker LifeHacker LifeHacker A carabiner that is convenient for cutting packaging at the entrance. Excellent sharpness for medical blades! [Today's life hack tool] lifehacker lifehacker LifeHacker LifeHacker A carabiner that is convenient for cutting packaging at the entrance. Excellent sharpness for medical blades! [Today's life hack tool]](http://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/223/2022-3-2/28016.jpeg)

![lifehacker lifehacker LifeHacker LifeHacker [2021] 7 Recommended Dishwashers | Introducing High Cospa & Compact Products lifehacker lifehacker LifeHacker LifeHacker [2021] 7 Recommended Dishwashers | Introducing High Cospa & Compact Products](http://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/223/2022-3-2/30293.jpeg)

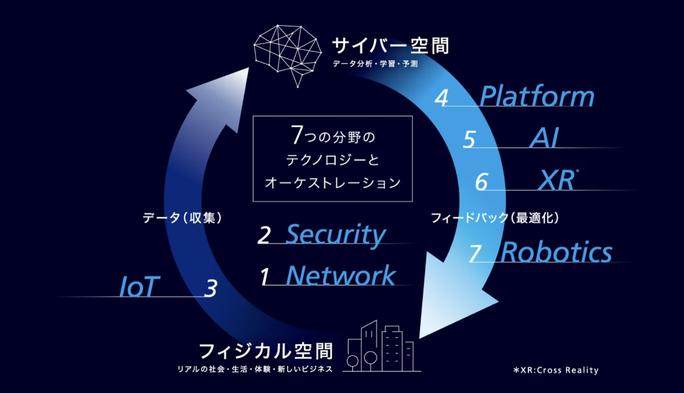

Will AI Concierge be realized in 2030? The future of KDDI's R & D (Part 1) | TIME & SPACE by KDDI

lifehacker lifehacker LifeHacker LifeHacker A carabiner that is convenient for cutting packaging at the entrance. Excellent sharpness for medical blades! [Today's life hack tool]

[2021] 11 latest recommendations for microwave ovens and ovens! Thorough explanation of how to choose

[A Certain Scientific Railgun] Popular character ranking TOP30!The first place is "Mikoto Misaka" [Survey results in 2021]