How much is the real estate acquisition tax of the apartment?How to take the reduction measure you need to remember and the case that will be tax -exempt | @Dime at Daim

When you buy an apartment, taxes are incurred for both the building and the site.Real estate acquisition tax is levied when you get real estate such as land and buildings.We will explain in detail the requirements and payment flow to reduce the amount of tax amount.

What is the real estate acquisition tax of the apartment?

Purchasing a property such as an apartment will result in taxes.This section explains the real estate acquisition tax that is levied when you get land and buildings.

Tax paid when you get real estate

"Real estate acquisition tax" is a tax on which you get real estate such as land and buildings.You need to pay only once when you get real estate for gifts or buying and selling, not just apartments.

In the case of an apartment, it is important to note that in addition to the residential area where you live, you can also find shared parts such as the entrance and corridor in the housing.The site use right is the land part, and taxes are applied to both houses and land.

The right to use the site is the right to divide the rights of the land where the apartment is built by the number of units.The ratio of the site use and the area of the shared part vary depending on the floor area occupied by the acquirer.

Payment destination and payment period

Real estate acquisition tax is a type of local tax, so it will be paid to prefectures.

Once you have a real estate such as an apartment, prepare the necessary documents and declare it to the local government tax office.The declaration of the declaration varies from local governments to confirm in advance.

After the declaration, a tax payment letter will be sent in about six months to one year.The timing of paying the real estate acquisition tax depends on the method of acquiring the real estate, and it may take time to calculate the tax amount.

Payments are possible not only from the tax office window, but also from financial institutions and post offices, so pay the deadline after receiving the notification.

Case where real estate acquisition tax is exempt

Real estate acquisition tax may be tax -exempt depending on the method and application method.The most common pattern is the inheritance of real estate.

When the real estate owner dies, heirs have the right to inherit real estate such as buildings as property.At this time, the heir does not acquire real estate on his own, so it is considered "formal ownership movement" and is tax -exempt.

However, if the owner is transferred to the real estate in his life, a real estate acquisition tax will be incurred because the acquisitioner is considered to have obtained real estate on his own.

Even with the same inheritance, it is not tax -exempt if you are not the heirs.

How much does the real estate acquisition tax cost?

(Source) Photo-AC.com

What is the real estate acquisition tax actually?Let's take a look at how to calculate and the tax rate.

How to calculate the real estate acquisition tax

The tax payment of the real estate acquisition tax is represented by the "tax standard x tax rate".

The original tax rate was 4 %, but the tax rate of land and residential buildings has been reduced to 3 % in response to the special case due to the epidemic of the new colon virus.

Usually, the "property tax valuation", which is usually registered in the fixed asset tax book, is the standard tax.It is important to note that the price when purchased is different.

In addition, the reduction tax reduction rate is applied to apartment land.The upper limit of the taxable floor area is 200 square meters, and the amount of one of the following is deducted.

The reduction measures will be applied to the real estate acquired by March 31, 2024.

Reference: Real estate acquisition tax | Taxes | Tokyo Metropolitan Tax Bureau

固定資産税評価額の調べ方

The property tax valuation required for calculating the real estate acquisition tax is determined by each municipality.

It is common for the person in charge to confirm and determine the valuation based on the "fixed asset evaluation standard" that summarizes the evaluation method of land and houses.

You can see the valuation of the real estate you already own by looking at the tax payment notice, but if you want to know the valuation of the real estate you want to buy in the future, it is a good idea to consult with a model room and ask for a guide.

It is recommended to ask an intermediary because the tax amount is already fixed for used properties.

However, the property tax valuation is reviewed once every three years.If the valuation changes, the tax amount paid will change, so it is convenient to know how to find out.

New construction may not be charged for real estate acquisition tax!

(Source) Photo-AC.com

When purchasing a newly built condominium, you can take reduced measures.Real estate acquisition tax may be zero, so let's check the requirements you care about.

Reduction measures for newly built houses

When acquiring a newly built house, you can receive a deduction of 12 million yen for the housing part, and if it is recognized as a long -term excellent house, you can receive a deduction of 13 million yen.

Since the deduction amount is deducted from the property tax valuation, the tax amount is "(property tax valuation -12 million yen) x 3%tax rate".

If the house you get is residential, it will be eligible for reducing measures.

One of the requirements is that the total floor area of the house is 50 to 240 square meters.Note that the total floor area includes the common parts of the apartment.

Basically, apartment requirements are the same as houses, but rental condominiums are not applicable to reduction measures.Real estate acquisition tax is limited when the ownership of the apartment is obtained.

Land reduction measures

The reduction measures are applied when the land is obtained.Condominiums are taxed on each building and land, so it is a good idea to understand the requirements for land.

The real estate acquisition tax on the land is calculated as "(property tax valuation x 1/2) x 3 % tax rate -light reduction".If the land acquired by 2024, the valuation will be halved, and if you meet the requirements, you will receive a deduction.

To take a reduction measure, you must build a new house within three years of land acquisition.Conversely, when the building is built first, you need to obtain land ownership within one year of architecture.

It is also important that the building part meets the requirements for reducing measures.

Reference: Metropolitan Tax: Real Estate Acquisition Tax | Metropolitan Tax Q & A | Tokyo Metropolitan Tax Bureau

An example where real estate income becomes zero

The real estate acquisition tax for the housing part has a deduction of up to 12 million yen (13 million yen for long -term excellent housing).

If the property tax valuation of the house is less than 12 million yen, the deduction amount will be negative, so there will be no real estate acquisition tax.

Similarly, the real estate acquisition tax on the land may be zero if the deduction amount is minus at the end.

Until 2024, the reduction tax rate is applied to the land, and the land price per square meter x 1/2 x (total floor area x 2) x 3%tax rate.

If this calculation result is 45,000 yen or less, the deduction amount will be 45,000 yen uniformly.

Reference: Reducing real estate acquisition tax / Chiba Prefecture

There are two ways to take reduced measures

(Source) Photo-AC.com

After confirming the application conditions for reduced measures, check the flow until you actually take the reduction measures.Here are two types of application methods.

Application at the same time as filing a real estate acquisition tax

The first is to declare that you have acquired the real estate and apply for a reduction measure.Go to the prefectural tax office window, collect the necessary documents, and apply.

The deadline for acquiring real estate varies depending on the local government, but basically 10-60 days are a guide.If you can not file a tax return within the deadline, you may not be able to receive reduced measures, so be prepared as soon as possible after the registration is completed.

Keep in mind that if the real estate acquisition tax is 0 yen, you will not receive a tax payment letter.

Reference: Real estate acquisition tax | Taxes | Tokyo Metropolitan Tax Bureau

Request for refund after declaration / tax payment

It is not unusual for a declaration procedure to be informed, as applying for a reduction measure requires a variety of documents.In such a case, it is a way to make a refund after paying the tax.

Get the "Real Estate Acquisition Tax Refund Order" at the tax office window or the website of the prefecture, and make a refund request for the necessary documents.

Although it depends on the local government, the main documents are as follows.

You can request a refund even after tax payment, but there is a limit on the refund period.Since the deadline is different for each local government, make sure to make inquiries.

Configuration / editorial department

![lifehacker lifehacker LifeHacker LifeHacker A carabiner that is convenient for cutting packaging at the entrance. Excellent sharpness for medical blades! [Today's life hack tool] lifehacker lifehacker LifeHacker LifeHacker A carabiner that is convenient for cutting packaging at the entrance. Excellent sharpness for medical blades! [Today's life hack tool]](http://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/223/2022-3-2/28016.jpeg)

![lifehacker lifehacker LifeHacker LifeHacker [2021] 7 Recommended Dishwashers | Introducing High Cospa & Compact Products lifehacker lifehacker LifeHacker LifeHacker [2021] 7 Recommended Dishwashers | Introducing High Cospa & Compact Products](http://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/223/2022-3-2/30293.jpeg)

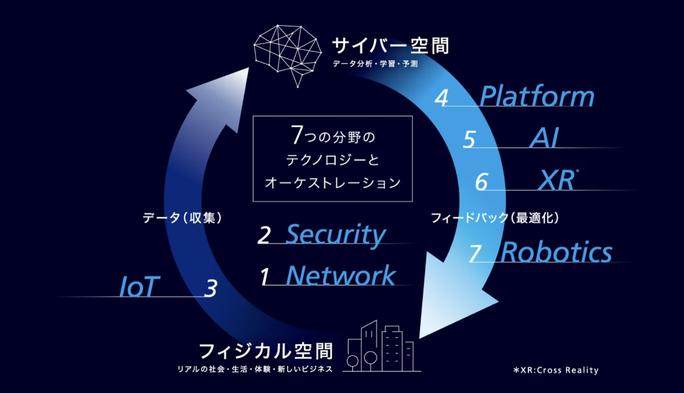

Will AI Concierge be realized in 2030? The future of KDDI's R & D (Part 1) | TIME & SPACE by KDDI

lifehacker lifehacker LifeHacker LifeHacker A carabiner that is convenient for cutting packaging at the entrance. Excellent sharpness for medical blades! [Today's life hack tool]

[2021] 11 latest recommendations for microwave ovens and ovens! Thorough explanation of how to choose

[A Certain Scientific Railgun] Popular character ranking TOP30!The first place is "Mikoto Misaka" [Survey results in 2021]