Does a gift tax also incur the gift between parents and children?do not do?| @Dime at Daim

"Gift tax" is a tax liven by a gift such as real estate or cash.Gifts between parents and children will be given a gift tax if a certain amount is exceeded.Make sure you have a tax obligation so that you do not miss the declaration.We will also explain the calculation method and the system that can be used to reduce it.

Case where gift tax is charged between parents and children

In some cases, taxes such as cash and land are generated by parents and children.When do you have a specific payment obligation?

More than 1.1 million cash gifts per year

"Gift tax" is a tax paid by the person who receives it when you receive a property from an individual.

In the “calendar year taxation” where the tax amount is determined based on the gift amount from January 1 to December 31, the basic deduction of the gift tax is up to 1.1 million yen per year.

If the amount of the gift is within the basic deduction, there is no need to file a gift or pay.

However, if you give or get cash between parents and children, a gift tax will be incurred if you exceed 1.1 million yen in one year.

If there is a cash gift of over 1.1 million yen a year, you need to declare to the tax office.You may think that gifts will not be discovered if you hand it over, but you may eventually be pointed out by the tax office.

It is important to note that if you discover that you have not filed a declaration despite the gift, you will be imposed on "non -declaration additional tax" or "delinquent tax".

As a result, if you receive more than 1.1 million yen, you should declare and pay the gift tax so that you do not have to pay extra taxes.

Reference: No.4402 贈与税がかかる場合|国税庁Reference: No.2024 When you forget the final tax return | National Tax Agency

Land, home gift and housing assistance

Gift tax will be incurred when the valuation of real estate given by parents and children exceeds 1.1 million yen per year.Even if it is not a new purchase or handed over, it is considered a "gift" when the name of the real estate is changed to a child.

If a parent takes over the repayment of a mortgage or a house purchase, a gift tax will be charged if the amount of assistance exceeds 1.1 million yen a year.The idea is the same in cases where parents paid some of the renovation amount.

If you receive assistance related to housing between parents and children, check in advance whether the gift tax will be incurred.

Gift of cars with name change

It is not unusual for children to use the car purchased by their parents as they are.However, if you change the name of a car over 1.1 million yen without paying the price, it will be eligible for gift tax.

The higher the price of the car, the higher the tax rate, so if you get a car free of charge, it is safer to check the assessed value and the buying and selling case on the Internet.

Also, if you buy and sell a car at a much lower price than the market, you may be taxed as a "deemed gift".

It is important to note that the price is not considered to be buying or selling, as it is considered the same as giving it.

Lending and borrowing that cannot be confirmed for borrowing or repayment

Even if you borrow money between parents and children, if the amount is too expensive and it is impossible to repay it, it will be considered a gift.It is not unusual for cash exchanges between families to not always assume repayment.

Lending and borrowing that do not promise repayment such as "Advance Payment" is considered to be a substantial gift and is subject to gift tax.

If you want to prove that lending over 1.1 million yen per year is not a gift, decide the repayment deadline after creating a formal borrowed letter.It is also important to set interest as well as normal borrowing.

If you repay in an account transfer, you can prove that the returned evidence remains and not a gift.If you can confirm that you are lending and borrowing or repayment, you will not have to worry about gifts.

Reference: No.4420 If you borrow money from your parents

Gift tax rate and calculation method

(Source) Photo-AC.com

If you receive gifts exceeding 1.1 million yen per year due to calendar year tax, you need to calculate the generated gift tax.Let's hold down the tax rate and how to calculate.

Tax rate that changes for minor and adults

When examining the gift tax rate, it is important that the "recipient" receiving the gift is adult.

If the person who received a gift from the directly affiliated (parents, grandparents, etc.) is over 20 years old as of January 1 of the year when the gift was given, it is a "special gift".If it does not apply to special gifts, all are "general gifts".

The tax rate and deduction amount are determined according to the "taxable price", which subtracts the basic deduction of 1.1 million yen from the amount of property received.

Special gifts apply to many cases in gifts between parents and children.Let's look at the tax rate and deduction amount of special gifts.

| 基礎控除後の課税価格 | 200万円以下 | 400万円以下 | 600万円以下 | 1000万円以下 | 1500万円以下 | 3000万円以下 | 4500万円以下 | 4500万円超 |

| 税率 | 10% | 15% | 20% | 30% | 40% | 45% | 50% | 55% |

| 控除額 | - | 10万円 | 30万円 | 90万円 | 190万円 | 265万円 | 415万円 | 640万円 |

Even if it is a gift from parents and grandparents, if the recipient is a minor, it is a general gift.The tax rate and deduction amount for general gifts are as follows.

| 基礎控除後の課税価格 | 200万円以下 | 300万円以下 | 400万円以下 | 600万円以下 | 1000万円以下 | 1500万円以下 | 3000万円以下 | 3000万円超 |

| 税率 | 10% | 15% | 20% | 30% | 40% | 45% | 50% | 55% |

| 控除額 | - | 10万円 | 25万円 | 65万円 | 125万円 | 175万円 | 250万円 | 400万円 |

In general gifts, the taxation price exceeds 2 million yen, so that the tax amount is higher than the special gift.

Reference: No.4408 Calculation of gift tax and tax rate (calendar year tax)

How to calculate gift tax

The gift formula formula is represented by "Taxation price x tax rate -deduction amount".

"Tax price" is the amount of tax actually imposed.Calculate by subtracting 1.1 million yen of the basic deduction from the amount given.

Next, check the tax rate that applies to your gifts, and then multiply with the taxable price and then negative the deduction amount.

Like the tax rate, the deduction amount also depends on the age of the receiving side.The higher the amount of the given property, the greater the tax rate and deduction amount.

For example, if a 40 -year -old person is given a property of 20 million yen from his real father (directly religious), the taxable price is "20 million yen -11 million yen = 18.9 million yen".

The tax rate is 45 % and the deduction amount is 2.65 million yen in the "special gift" received by adults from directly affiliates.The amount of the gift tax to be paid is "18.9 million yen x 0.45-265 million yen = 5855,000 yen.

How do you not impose gift tax between parents and children?

(Source) Photo-AC.com

Even if you receive cash gifts and support, depending on the amount, you will get a large amount of gift tax.Is there a way not to pay a gift tax?

Let's take a look at cases that are tax -exempt from the beginning and how to save tax.

Tax exempt when used for living expenses and education expenses

Even if you receive your property from your parents, there will be no gift tax if you use it as "living expenses" or "education expenses".

Parents and grandparents have a duty to support children.Considering the economic burden, the money required for life is not subject to tax.

There is a system that is not taxed when giving a large amount of tuition, marriage, childbirth, and child -rearing.

However, it is an exception to use the money given as living expenses and childcare expenses in an account, or to use the funds to purchase stocks.Be careful as it is considered to be used for another purpose and a gift tax will be charged.

Reference: No.4510 直系尊属から教育資金の一括贈与を受けた場合の非課税|国税庁Reference: No.4511 Tax exemption if you receive a collective gift of marriage and child -raising funds from directly affiliated | National Tax Agency

Utilizing the "deduction" and "tax -exempt" system

The gift tax tax method is not only the calendar year taxation with a basic deduction of 1.1 million yen per year.By selecting the "Inheritance Tax Settlement Tax System", you can also receive a more expensive special deduction.

The inheritance tax payment system is a system that calculates the amount of inheritance tax from the total amount of the gift received and the property obtained by inheritance when the gifts have died, and pay the tax.

However, it is not possible to use both deductions because it is necessary to choose either method.

In addition to "deductions", which are deducted from the tax reduction measures, there is also a "tax -exempt system" that does not impose taxes even if taxable.

The deduction and tax exemption system can be used together, so understand the system that can be used for gifts between parents and children and use it in tax saving.

Reference: No.4103 Selection of inheritance settlement tax | NTA

A system that can reduce the amount of tax by gifts between parents and children

(Source) Photo-AC.com

What kind of specials and systems can be used specifically to avoid high -priced taxes by gifts between parents and children?Let's check the types of usable systems and the applicable requirements.

Special case for housing funding gifts

What can be used when purchasing your own home or condominium is a special case for housing acquisition funds.

When receiving assistance from parents for new housing construction and purchase, up to 30 million yen is tax -exempt.However, it is characteristic that the maximum tax -exempt amount changes depending on the time when the contract for purchasing a house is concluded.

Depending on the consumption tax rate when you get a house, the maximum tax -exempt amount is different, so check the year of acquisition and contract.

To be applied to the special case, as of January 1, the year of receiving a gift, you must have a supported child and grandchildren over 20 years old.One of the requirements is that the income of the gift of the gift is less than 20 million yen this year.

Reference: No.4508 Tax exemption when receiving funds such as housing acquisition from directly affiliated | NTA

Inheritance settlement taxation system

If you want to give a high cash in a short period of time, you can use the "Inheritance Settlement Taxation System".It is a system in which a maximum total of 25 million yen gifts are tax -exempt.

However, there is no need to pay taxes.Properties given using the inheritance settlement taxation system will be charged when the gifted parent dies.

It is also important to note that if you use the inheritance settlement taxation system at least once, the basic deduction of the calendar year tax will not be applied.

When choosing a gift taxation system, consider the amount you receive and hand over and the future expenses.

Reference: No.4103 Selection of inheritance settlement tax | NTA

Bulk gift for marriage and child -rearing

When a dependent gets married, if it is funded for marriage or child -rearing, a lump -sum gift of up to 10 million yen will be exempt.The requirement for applying is that those who receive gifts are "20 and 50 years old" and have not earned more than 10 million yen the previous year.

To apply, it is necessary to submit the "Marriage / Child Care Fund Exemption Form" to the tax office through financial institutions.A receipt that proves expenses related to marriage and childcare must be submitted to financial institutions.

Childcare expenses are not included in tax subjects, but it takes time to send them in subdivisions when needed.The advantage of lump -sum gifts is that even if you give a large amount at a time, there will be no tax, and you will be able to save the trouble of each gift.

There is also a system in which the lump -sum gift of educational funds is tax -exempt.Since the procedure is automatically performed by financial institutions, it is convenient not to file a declaration.

Reference: No.4510 Tax exemption in the event of a lump -sum gift of education funds | NTA Reference: When you get property | NTA

How to declare gift tax

(Source) Photo-AC.com

In the event of a gift tax, you need to declare to the tax office.In order to avoid delinquent taxes, know the deadline for filing and the necessary documents.

Declaration to the tax office within the deadline

It is the person who has been given the gifts that are obliged to file a gift tax.The gift tax will be taxed on the gifts received by December 31 of the year, so the declaration will be the year after the gift.

Since the tax return deadline is from February 1 to March 15, it is necessary to prepare early so that you do not forget.

The documents required to file a tax return can be obtained from the "Gifts Tax Tax Form", from the tax office window and the following "[Procedure Name] Gift Tax Declaration Procedure".

Once you have created a tax return, submit it to the tax office window along with a copy of the gift contract.In addition to the method of mailing documents, you can also declare online online in E-Tax from the guidance on the "Gift Tax Declaration" page below.

[Procedure name] Gift tax declaration procedure | NTA Gift Tax Declaration | NTA

Documents required for gifts tax declaration

When filing a gift tax, the required documents differ depending on the system used.In addition to the gift tax report, the necessary documents common to any system are as follows.

When choosing a settlement taxation at the time of inheritance, a "Inheritance Tax Selection Selection Notification" is required.Download the link below and fill in the necessary information.

If you use the tax exemption system of housing acquisition funds, you need to have a withholding slip that allows you to confirm the amount of income and a copy of the construction contract for the house, and a document that can confirm the contract for housing.

When using the tax -exempt system, a copy of the recipient's family register is required regardless of the type.

Format of the inheritance settlement tax selection notification form

Anxious questions about gift tax between parents and children

(Source) Photo-AC.com

When a gift occurs between parents and children, it is difficult to judge the gift tax.Clearing points that are likely to be questioned will help you to judge when you are actually given.

What if I changed the name of the real estate?

If the real estate, which is in the name of the parent and child, into the name of the child, the gift tax will be charged if the parent's name is over 1.1 million yen.It would be safer to check the valuation of the real estate in advance.

For real estate gifts, it is recommended to consult with tax accountants and other experts because the land evaluation method is complicated.

If you want to take tax saving measures, you can reduce the tax paid by giving real estate in small divisions every year.

What is your righteousity and adoptive idea?

When receiving gifts from the righteous family, it is important to note that "direct religion" is only parents, grandparents, etc., and parents of marriage are not included.Gifts from mother -in -law and Yoshio are "general gifts" even if they are over 20 years old.

If you are directly from the genus, you will be charged a gift tax for living expenses and childcare expenses that are not a gift tax.

If you receive childcare and educational expenses from your family, you can avoid gifts tax if your spouse is a recipient.Batch gifts of educational funds are also tax -exempt.

In the case of adoption, you need to be careful because the way of thinking is completely different from the righteous family.Adopted children and parents are officially considered "parent and child", and if the child is over 20, the tax rate for special gifts will be applied.

Think of all the systems and special cases applied between blood -connected parents and children to all the adopted parent and child.

What if it is given by a parent's corporation?

If a parent runs a corporation such as a company or a public interest foundation, it is possible to give a gift to a child as a corporation.

Gift tax is a tax led by individuals to personal gifts, so there is no gift tax from a corporation to an individual.

However, gifts from corporations include "income tax" instead of gift tax.If you receive property, such as securities, real estate, etc., you will be taxed as a temporary income, so make a tax return and pay the tax correctly.

Configuration / editorial department

![lifehacker lifehacker LifeHacker LifeHacker A carabiner that is convenient for cutting packaging at the entrance. Excellent sharpness for medical blades! [Today's life hack tool] lifehacker lifehacker LifeHacker LifeHacker A carabiner that is convenient for cutting packaging at the entrance. Excellent sharpness for medical blades! [Today's life hack tool]](http://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/223/2022-3-2/28016.jpeg)

![lifehacker lifehacker LifeHacker LifeHacker [2021] 7 Recommended Dishwashers | Introducing High Cospa & Compact Products lifehacker lifehacker LifeHacker LifeHacker [2021] 7 Recommended Dishwashers | Introducing High Cospa & Compact Products](http://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/223/2022-3-2/30293.jpeg)

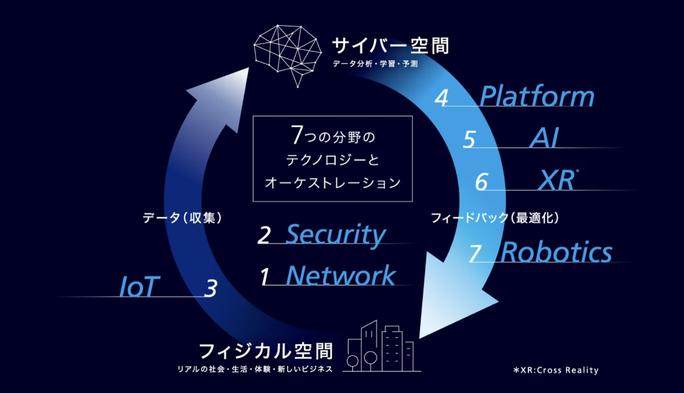

Will AI Concierge be realized in 2030? The future of KDDI's R & D (Part 1) | TIME & SPACE by KDDI

lifehacker lifehacker LifeHacker LifeHacker A carabiner that is convenient for cutting packaging at the entrance. Excellent sharpness for medical blades! [Today's life hack tool]

[2021] 11 latest recommendations for microwave ovens and ovens! Thorough explanation of how to choose

[A Certain Scientific Railgun] Popular character ranking TOP30!The first place is "Mikoto Misaka" [Survey results in 2021]