With e-tax, you can complete the procedure from January!How to get a final tax return | @Dime at Daim

If you make a year -end adjustment at the company, you will be able to receive various deductions without a final tax return, but you can receive over -paying tax refunds by filing a tax return.

Deductions that are only for year -end adjustment

Companies employees are generally deducted from salary income, such as the year -end adjustments to be submitted to the company by early December, such as the “Deduction of Depends on Salary Income Company” and “Deduction of Salary Income Deduction”.Is complete.Various deductions that can be deducted from salary income at this year -end adjustment are human deduction and insurance premium deduction.Human deductions can reduce income if there are families that are dependent on spouse deduction (or special spouse deduction), deduction for persons with disabilities, and dependent deductions.If you are paid by those who declare the deduction of insurance premiums, such as the life insurance premiums, earthquake insurance premiums, or social insurance premiums such as the family's health insurance premium and the national pension insurance premium if it is not dependent.You can deduct from your income.

In addition, even for hometown tax payment, if donations are within 5 places using the one -stop special system, you can receive a donation deduction.

Therefore, many employees do not basically file a tax return, and many people do not want to file a tax return.

However, if you are currently E-Tax, you can file a final tax return procedure, and if it is only a tax return like a company employee, it is not so difficult, so it corresponds to the following items that can receive the next refund.If you have a tax return, it is recommended to regain too much tax.

Examples of receiving tax refunds by tax return

① Mortgage deduction (1st year)

The first year of receiving a mortgage deduction is required.From the second year, you can receive a deduction for year -end adjustment, but in the first year you will need to file a final tax return, and if you can not receive a one -stop tax payment of hometown tax payment, you will be declared for donations if you pay hometown tax.There is a need.

② 5 super hometown tax payment

A final tax return is required if a tax return such as the first year of the mortgage deduction described above is required and if you pay more than 5 hometown tax.The one -stop special case is reduced only from the resident tax, but if you file a hometown tax payment in a final tax return, you will receive a donation deduction in the case of a company employee, a refund of income tax and a resident tax reduction paid from June.It will be.

③ Medical expenses deduction, self -medication tax system

You can select either medical expenses deduction or self -medication tax system and receive income deduction.People with medical expenses can be targeted even if they are not supported if they are the same, and deductions can be received even if they are not high income among the couples (more generally higher income is higher.The tax saving is large.)

・医療費控除

Expenses such as medical expenses, pharmaceutical purchases, hospitalization expenses, medical equipment purchases, etc. can be deducted from income (if the total tax standard is less than 2 million yen, the total amount of taxation standard (after deduction after deduction)Amount) x 5 %).

For example, if you pay 150,000 yen in combination with medical expenses and pharmaceuticals, you can receive a 50,000 yen income deduction.If the annual income is 4 million yen (income tax rate is 10%and resident tax income is 10%), the tax of 10,000 yen will be reduced.

・セルフメディケーション税制

If the filer himself is taking a certain level of health, such as a health checkup or vaccination, the amount of the switch OTC drug can be deducted over 12,000 yen (88,000 yen limit).For example, if you pay 100,000 yen for switch OTC drugs, 8.You can receive an income deduction of 80,000 yen.If the annual income is 4 million yen (income tax rate is 10%, resident tax income is 10%), 1 is generally 1.The tax of 760,000 yen decreases.Switch OTC drugs are diverted from medical use to commercial use, and whether or not they are targeted at the top of the drug name receiving at pharmacies and drugstores is marked at the top of the drug.

In order to apply a self -medication tax system, a certain level of efforts for health is required, but the cost for a certain level of efforts is not deducted.

④ Transfer loss on stocks, investment trusts, etc.

In transactions such as stocks and investment trusts, there is no need to file a tax return in the case of an account with NISA accounts, specific account withholding tax, but if you are trading a securities company with two or more companies, you will be tax return if you end up with one loss.You can get a tax refund paid too much.If there is still a loss, the loss will be deducted for three years from the following year and offset the profit for the next three years.

⑤ Distribution deduction, foreign tax deduction

・配当控除

You can receive a dividend deduction by selecting a comprehensive tax on dividends.If the total taxable income (including dividends) exceeds 10 million yen, you can receive a deduction of 5%and 10%for 10 million yen or less (2 for investment trusts)..5%, 5%).However, due to the selection of comprehensive taxation, the original dividend is uniformly 20..Since 315 % of tax (income tax, resident tax, special income tax), those who have higher tax rates will increase the tax rate on dividends by selecting comprehensive taxation.Therefore, it is worth receiving a dividend deduction if the taxable income amount is 9 million yen or less (the amount of income deduction from the amount after deduction of salary income).

・外国税額控除

If a local tax is deducted by a dividend of foreign stocks, etc., and the tax is levied in Japan, the tax return can be received by the tax return.If you buy foreign shares at a domestic securities company and receive dividends, if you have an account with a specific account withholding tax, it is also withholding with the localization and withholding at the time of receipt by domestic securities.The double taxable part can be refunded by tax return.If you purchase at a local securities company, you will always need a final tax return.

⑤ Specified expenditure deduction of salary income

You can deduct more than 1/2 of your salary income deduction by spending the cost of work.

For example, if you have a salary income of 4 million yen, the salary income deduction is 1.24 million yen, and if there is an expenditure that corresponds to more than 620,000 yen in this 1/2, it can be deducted.In addition, the part of the tax exempt from the workplace and the part of the education training benefit is not applicable.

■特定支出

・ Commuting costs (parts that exceed 150,000 yen per month by commuting allowance (due to taxation), parts that are paid by yourself) ・ Travel travel expenses ・ Transfer costs ・ Training costs, training costs, qualification costs ・ Single transferExpenses, books, suits, entertainment expenses, etc. for returning home (650,000 yen limit only for this item)

If it costs 800,000 yen as a specific expenditure, a person with an annual income of 4 million yen will be able to deduct 180,000 yen.

Can be filed from January with e-Tax

The 2021 declaration will be filed from the E-Tax tax return formation corner released in early January 2022.

Before the declaration, we will collect with the medical expenses format that can be downloaded at the E-TAX final tax return formation corner and the dividend aggregation form, and collect withholding tax, annual transaction report, and other statements.Good.

Also, if you prepare your My Number card, it is convenient because you can immediately check your identity by reading your smartphone and start declare.

Once the 2021 tax return creation corner is released, we will immediately start declaration of income tax and enter as specified while looking at the withholding slip.Even if you do not understand the term, you can refer to the diagram of which part to enter.If you only refund, you can declare it in about a day, so if you have an item that can be deducted, it is recommended to file a tax return.

Increase steadily with [NISA] [iDeCo] [Point Investment]!Introduction to solid investment of girls alone

"I want to get married, but if I don't ...?" "I want to enjoy a single life, but in the future ..." "If I break up with my current husband ..."。I don't know what will happen to the future because the times change.However, if you are prepared, you will not worry.Why don't you proceed steadily from what you can do now for the future?In this book, Mr. Ohori, who provides advice on creating a life plan, reviewing household budget, and managing assets, focuses on investment trusts, iDeCo, and point investment.I recommend it!

詳細はコチラSentence / Takako Okobori is good at managing articles as a free writer.She is a representative of Ohori FP Office, CFP certified, and Foreign Securities.

![lifehacker lifehacker LifeHacker LifeHacker A carabiner that is convenient for cutting packaging at the entrance. Excellent sharpness for medical blades! [Today's life hack tool] lifehacker lifehacker LifeHacker LifeHacker A carabiner that is convenient for cutting packaging at the entrance. Excellent sharpness for medical blades! [Today's life hack tool]](http://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/223/2022-3-2/28016.jpeg)

![lifehacker lifehacker LifeHacker LifeHacker [2021] 7 Recommended Dishwashers | Introducing High Cospa & Compact Products lifehacker lifehacker LifeHacker LifeHacker [2021] 7 Recommended Dishwashers | Introducing High Cospa & Compact Products](http://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/223/2022-3-2/30293.jpeg)

lifehacker lifehacker LifeHacker LifeHacker A carabiner that is convenient for cutting packaging at the entrance. Excellent sharpness for medical blades! [Today's life hack tool]

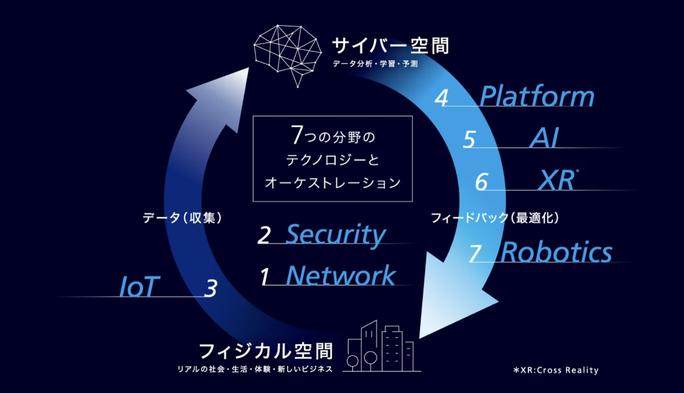

Will AI Concierge be realized in 2030? The future of KDDI's R & D (Part 1) | TIME & SPACE by KDDI

[2021] 11 latest recommendations for microwave ovens and ovens! Thorough explanation of how to choose

How to delete all Gmail unnecessary emails | @Dime at Dime